Many companies need outdoor services to meet their day-to-day obligations. But what is the cost of an employee for outdoor services?

Hiring and insuring an outsider is not the only way out of your business. We also count the parallel costs related to the vehicle, its maintenance, as well as the additional costs that this entails.

We did our research – purely based on the current legal framework – and we present you our conclusion, giving modern solutions to reduce the fixed costs of your business.

Table of Contents:

Outdoor work vehicle’s costs

We will assume that the exterior work vehicle will be a motorbike up to 300cc (obviously the costs skyrocket in the case of a car).

There are 2 cases:

- Use of the employee’s motorbike (compensation 117 € / month)

- Use of a proprietary motorbike of similar specifications.

The only thing that changes in the costs between the 2 above cases is the purchase value of a privately owned motorbike, which ranges at 3500€.

Knowing from our experience that an outdoor work vehicle travels 100-120km per day, the following fixed costs arise per case.

Α. Compensation costs – employee vehicle costs

| Fixed Expenses | Year Expenses | Month Expenses |

|---|---|---|

| Service | 250€ | 20,83€ |

| Tires / Battery | 100€ | 8,33€ |

| Unforeseen damage | 30€ | 2,5€ |

| Annual Road Tax | 22€ | 1,83€ |

| Car insurance (with roadside assistance) | 150€ | 12,5€ |

| Equipment (helmet, raincoats, boots, bluetooth) | 80€ | 6,66€ |

| Fuel (20 working days) | 1440€ | 120€ |

| Monthly Compensation | 1404€ | 117€ |

| Σύνολο | 3476€ | 289.65 |

B. Cost-expenses of a privately owned vehicle

| Fixed Expenses | Year Expenses | Month Expenses |

|---|---|---|

| Service | 250€ | 20,83€ |

| Tires / Battery | 100€ | 8,33€ |

| Unforeseen damage | 30€ | 2,5€ |

| Annual Road Tax | 22€ | 1,83€ |

| Car insurance (with roadside assistance) | 150€ | 12,5€ |

| Equipment (helmet, raincoats, boots, bluetooth) | 80€ | 6,66€ |

| Fuel (20 working days) | 1440€ | 120€ |

| Monthly Compensation | 700€ | 58,33€ |

| SUM | 2772€ | 230.98 |

Motorbike 300cc

Salary costs of an external employee

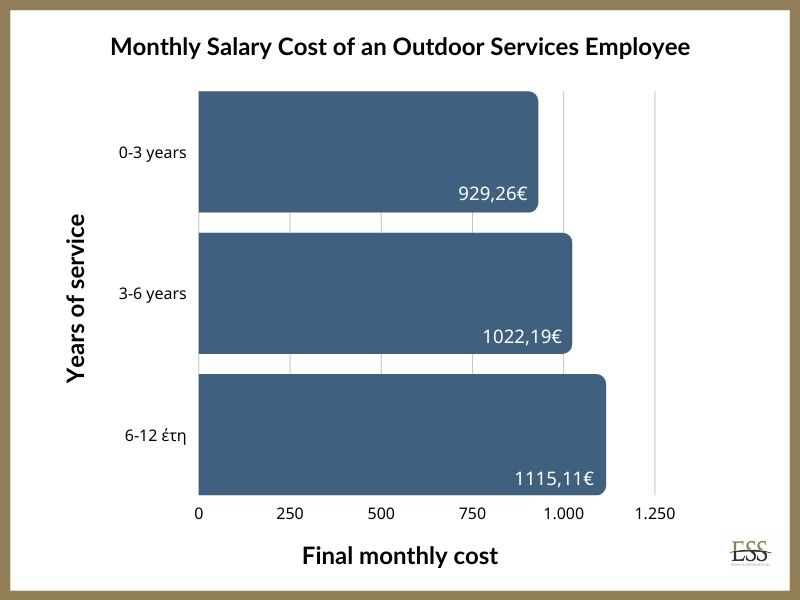

Depending on the previous service years of an employee, the salary costs are as follows:

Previous service 0-3 years

| Salary | 650€ |

| Employee contributions | 91,78€ |

| Employer contributions | 146,51€ |

| Net earnings | 558,22€ |

| Total cost & subsidy OAED | 796,51 |

| x 14 months | 11.151,14 |

| Final monthly cost | 929,26 |

Excludes any cost of compensation due to dismissal or retirement

Previous service 3-6 years

| Salary | 715€ |

| Employee contributions | 100,96€ |

| Employer contributions | 161,16€ |

| Net earnings | 614,04€ |

| Total cost & subsidy OAED | 876,16€ |

| x 14 μήνες | 12.266,24€ |

| Final monthly cost | 1.022,19€ |

Excludes any cost of compensation due to dismissal or retirement

Previous service 6-12 years

| Salary | 780€ |

| Employee contributions | 110,14€ |

| Employer contributions | 175,81€ |

| Net earnings | 665,07€ |

| Total cost & subsidy OAED | 955,81€ |

| x 14 μήνες | 13.381,34€ |

| Final monthly cost | 1.115,11€ |

Excludes any cost of compensation due to dismissal or retirement

Cost of permanent employee in depth of 10 years

The cost of a fixed external employee in depth of 10 years with simple calculations is:

| 929,26 x 12 x 3 years | 33.453,36€ |

| 1022,19 x 12 x 3 years | 36.798,84€ |

| 1115,11 x 12 x 4 years | 53.525,28€ |

| SUM | 123.777,48€ |

| + 34.760€ (employee’s motorbike) | 158,537,48€ |

| ή + 27.720€ (owned motorbike) | 151.497,48€ |

Approximate consideration should also be given to:

- 22 days leave / per year

- Sick leave

- Holidays

- Dismissal or resignation and cost of training-adjustment of a new employee

- Times when the need for outside work is declining dramatically.

Outdoor services employee VS ESS

Why outsource your work to ESS:

- We are by your side and you only pay us when you need us. In other words, you do not have fixed costs. You choose the way of our cooperation, fixed package or time charge.

- You do not need to worry about vehicle costs. We also have special transport vans whenever you need them.

- For us there are no excuses, holidays and off-time.

- We have parallel services to meet the needs of your business:

Let’s schedule an appointment for:

- Analysis of your needs

- Adaptation of our Services to your needs

- Costing based on requirements

- Choice of billing method based on your interest